Happy 26th Birthday! Hope you have a great day and you've lined up health insurance!

What happens when you reach that magical age when you finally learn what a deductible is

This week, my oldest child celebrated her 26th birthday. In what seems like a blink of an eye, she went from the age when birthdays meant presents and parties to a time when a birthday means you have to have your shit together about something.

Of course Cassie still got to celebrate with friends and was treated to a day of fun with her parents. But birthday #26 also meant she had to make sure she had her own health care insurance lined up.

That’s right–if you’re about to turn 26, prepare for a rite of passage–you’re now old enough to finally learn what deductibles, PPOs, and in-network providers are. At 26, you become responsible for carrying your own health care insurance.

Yes, I know it isn’t as fun as the birthdays that bestowed other adult privileges on you like a driver’s license or the ability to legally purchase alcohol. But welcome to another step on the path to full-fledged adulthood.

And consider yourself lucky that you’ve been spared this long. Until 2010, young adults became responsible for their own health insurance coverage as soon as they were no longer a student. But thanks to the Patient Protection and Affordable Care Act, people were granted the ability to stay on their parents’ health plans until they turned 26.

Once you turn 26, you can no longer be blissfully unaware of how health care insurance works. As Monica told Rachel in the first episode of Friends, “Welcome to the real world. It sucks. You’re gonna love it.”

Do I really lose coverage on my actual birthday? That seems kind of mean

If you're covered by a plan that your parent has through an employer, your coverage usually ends during or shortly after your 26th birthday month.

If you're on a plan that your parent obtained through the Health Insurance Marketplace, you can remain covered through December 31 of the year you turn 26 (or the age permitted in your state).

Some states and plans have different rules. So you should check with the plan or your parent’s employer for the exact date.

Do I really have to do something about this as soon as I’m turning 26?

Yes, you need to take action. If you don’t, you won’t have health coverage. Since you never know when a major illness will strike and you can’t control whether you’ll be in an accident, health care coverage is a necessity even if you’re young and healthy.

Though you may tell yourself you can just “pay as you go” if something happens, you may be sorry. For instance, if you break your leg, it can cost as much as $7,500 to treat it. You would be wise to consider at least having a catastrophic health plan in case a worst-case scenario becomes reality.

Okay, so I have to have a health plan of my own. How do I get one?

If you have a job and your employer offers a health care plan, the easiest and most economical option is to enroll in that plan.

You can also find a health plan independently through the Health Insurance Marketplace, a service run by the federal government or your state government that helps people shop for health insurance. However, it will cost you more money to purchase health insurance independently if your employer offers a health insurance plan. Take a peek at all of the steps involved in shopping for a health plan at Uncle Sam’s website Healthcare.gov, and you’ll see for yourself that the path of least resistance is to go with your employer’s plan.

If you're still a student, you may be able to enroll in a student health plan offered by your school. This will likely be the easiest and most affordable way to get coverage. Uncle Sam talks more about this situation here.

What is this thing called open enrollment that I keep hearing about?

As soon as you start hearing ads for pumpkin spice lattes, you can be certain that ads mentioning open enrollment aren’t far behind. Most employers have an open enrollment period for benefits every fall during which their employees can make changes to their employee benefit selections. (Geezers eligible for Medicare also have an open enrollment period every fall too.)

Your employer’s open enrollment period is a great time for you to familiarize yourself with health insurance coverage even if you’re currently covered by your parents’ health insurance plan. Read through the materials that your employer sends your way; most open enrollment materials usually do a good job of explaining your options. (NPR’s Life Kit recently posted a handy guide about what to keep in mind when choosing a health insurance plan.)

You may find that your employer’s plan offers you better coverage than what you’re currently receiving under your parent’s plan. Who knows–maybe your employer’s plan covers gym memberships or offers a vision plan that would provide your contact lenses or a new set of glasses for free.

And even if you don’t end up enrolling in coverage under your employer’s plan this year, it’s a chance for you to get familiar with how health insurance works. Think of it as a chance to do a dry run before you have to choose things for real.

How do I get on my employer’s plan if I’m turning 26 and it’s not an open enrollment period?

If your employer offers health insurance plans, losing coverage under your parent’s plan qualifies you to enroll in the plan outside its yearly Open Enrollment Period. (When my husband changed jobs this past summer, it qualified as a “life event” that allowed my oldest daughter to enroll in her employer’s plan.) Contact your human resources representative before turning 26 to learn your next steps.

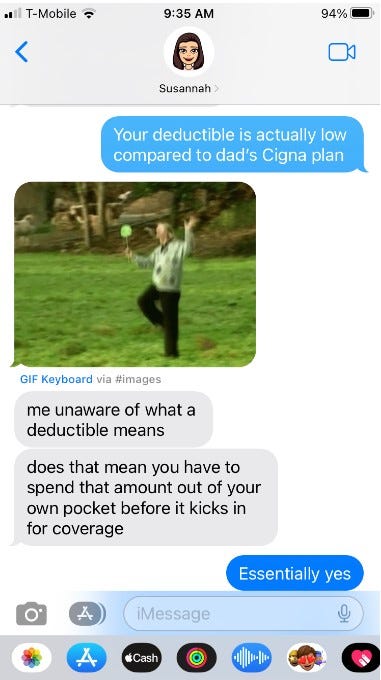

What is a deductible anyway?

That’s something that you’ll understand better once you turn 26 haha.

Basically, it’s the amount you pay out of pocket for health care services before your health insurer starts to pay all of the bills. If you have a $1,500 deductible, you pay for the first $1,500 of services yourself. Once your healthcare bills for covered services exceed this amount, the insurer pays the rest of the tab.

There are so many variations of coverage and deductibles (wait til you find out what a premium is), that it will actually make more sense if you learn about them in the context of the plan that’s actually available to you.

If you read the open enrollment materials from your employer, they’ll explain things like deductibles, copays, and in-network providers. You can also check out Life Kit’s handy health insurance glossary.

Is sorting things like your health insurance out a pain?

You betcha. It would be nice if things like this just happened automatically. But health insurance coverage is one of the responsibilities of adulthood–think of it as self-care on a grand scale.

And keep in mind that the first time you take care of this will be the hardest. When you enroll the next time, you’ll have what you’re already doing as a baseline. If it’s working, you can leave it alone. If it isn’t, you can try to improve your situation.

I hope this overview gives you a baseline of what to expect once you’re responsible for your own health insurance. Just remember that rules and regulations can vary by state and may change after this piece is published, so be sure to investigate what the deal is when you near your 26th birthday. Good luck, and happy birthday!

I’m curating a “Books of Wisdom” collection for you that covers all of the topics on the minds of people trying to get their lives together–love and relationships, career, finding meaning and purpose in life, and life hacks. In every issue, I’ll offer samples from the Book of the Month so that you can assess whether this book would be a good read for you.

According to Burnett and Evans, designers don’t think their way forward; designers build their way forward

Instead of dreaming up a lot of fun fantasies that have no relationship to the real world, Burnett and Evans encourage you to be committed to building your way forward.

They note that designers try things, test things out, and create prototype after prototype until they find what works. Sometimes they even find that the problem is entirely different from what they first thought it was.

Instead of focusing on comprehensively researching the best data for all aspects of a plan, Burnett and Evans recommend building “prototypes” to explore questions about alternatives. (They provide numerous tools for doing this in the book.)

They also note that design is a collaborative process, and many of the best ideas are going to come from other people. Designing Your Life describes how to get advisers and mentors to assist and shows how to formulate the right questions to ask. Check it out!

In the olden days, moms used to clip articles from newspapers for their kids if they thought it was something they needed to know. I’ll be keeping an eye out for things that you might have missed that may be helpful to you.

This week’s clips:

Yale professor Dr. Laurie Santos has studied the science of happiness and found that many of us do the exact opposite of what will truly make our lives better. The Happiness Lab podcast helps clarify what it really takes to lead a happier life.

Should you be worried about the aspartame in Coke Zero being named a possible carcinogen? An epidemiologist says probably not.

A job interview should be a two-way conversation, which means the interviewee should be asking questions too. The director of the National Association of Colleges and Employers suggested the top questions job seekers should be asking.

Next Week: Do the hustle? Is hustle culture the secret to success or the gateway to a toxic mindset?