I hated my first part-time job. The summer I was 16, I worked the catering line at a small local amusement park. You might think it would have been fun to work someplace with a tilt-o-whirl and a roller coaster, but I sure didn’t. Shift after shift, I slopped beef barbeque into buns. I hated working in food service, but none of the other jobs I’d applied for had come through.

As much as I wanted to leave that job, my mom insisted I keep working. I’d recently gotten my learner’s permit, and my mom had informed me that I was responsible for paying my car insurance premium every six months. Until and unless I found another job to replace it, I would be slinging beef barbeque.

One day, a picnicgoer invited me to smoke a joint with him on my break. I was sure that once my mom heard that, she’d finally let me hand in my notice. But I was wrong. Though I thought my mom was being mean, what I didn’t recognize at the time was how committed she was to teaching me to become economically self-sufficient.

But my mom must have realized that starting to do adult things like driving a car was the perfect time to introduce me to the adult responsibility of paying for those privileges.

The next lesson came when I was about to head off to college. Mom told me that paying for all books, incidentals and clothing would now be on me. It wasn’t a bad deal since my parents covered the larger bill for my room and board (a scholarship was covering my tuition).

Now I had to ensure that I could cover some of my needs as well as my “wants.” That summer I was motivated to work enough hours at my Macy’s sales clerk job (which I liked way better than my catering job) to build up my bank account.

Though my mom never formally declared that she was putting me on the path to financial independence, that’s exactly what she did. If she hadn’t started the ball rolling, I probably wouldn’t have been in a hurry to start picking up the tab for my expenses. Getting used to paying my bills wasn’t a walk in the park, but my mom did me a solid, helping me to gradually learn the critical skill of supporting myself.

How many 20-somethings are financially independent?

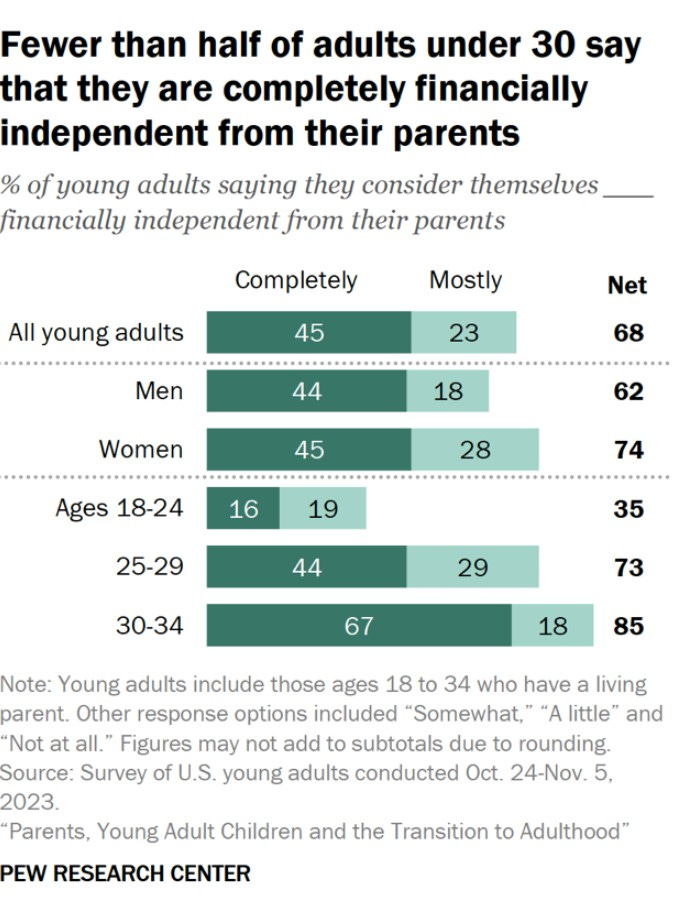

According to a recent Pew Research study, 44% of adults ages 25-29 say they are completely financially independent from their parents. Another 29% say they are mostly financially independent.

Only 16% of adults ages 18-24 say they are completely financially independent from their parents. Another 19% say they are mostly financially independent. (These percentages are likely affected by the fact that some in this age group may be in college.)

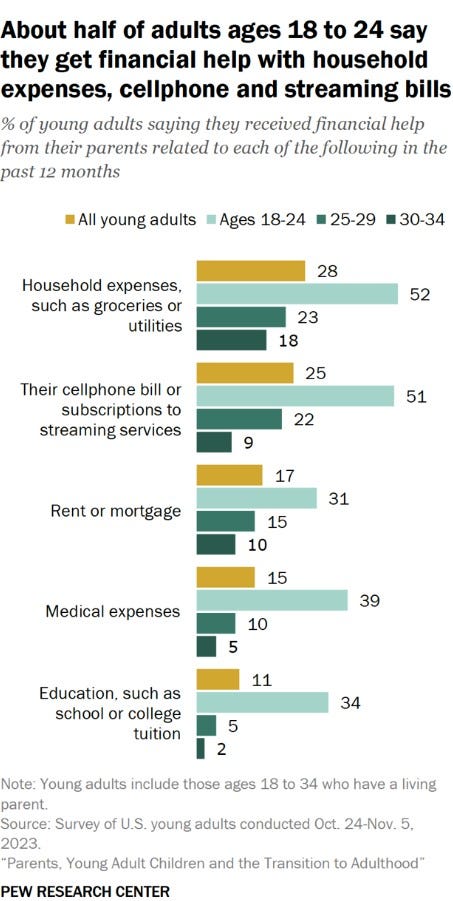

The most common financial help young adults receive is for household expenses, cellphone bills, or streaming service subscriptions (22%).

Three-quarters of young adults who say they’re not completely financially independent say it’s extremely or very likely that they will eventually be. And their parents are similarly optimistic–72% of parents believe it is extremely or very likely that their child will eventually be financially independent.

What’s the big deal if your parents still pay some of your bills?

Some parents are so used to financially supporting their kids that they continue doing so without thinking about it. Other parents may be hesitant to place additional financial burdens on their offspring. According to a 2022 Pew Research Center study, seven in ten Americans say that young adults today face more challenges than their parents’ generation when it comes to saving for the future, paying for college, and buying a home.

Even if your parents are contributing to your upkeep with the best intentions, this situation shouldn’t continue indefinitely. In general, non-disabled adults who can work should be, or at least be on the path to becoming, self-sufficient. Though it’s less common these days for parents to expect their kids to be financially independent as soon as they graduate high school, that should still be the goal that everyone is working toward.

Continued financial dependence is bad for you

When you’re financially dependent on someone, it’s harder for them to regard you as totally independent. If you’re receiving what amounts to a financial handout from your parents, they’re less likely to respect you as a sovereign entity. You are more vulnerable to the possibility that your parents may wish to have some say about your decisions.

In fact, the reality is that some parents don’t mind paying their kids’ bills because it allows them to maintain some degree of control over them. If you want to be a fully independent adult, you must recognize that being on your parents’ payroll will make that less likely.

Continued financial dependence is bad for your parents

Once you’re grown, your parents need to turn their attention to their own financial needs. After all, for the past two decades or more, much of their budget has gone towards supporting you, your siblings, and all of the overhead associated with maintaining a household. They may have been planning to sock away some additional savings during their pre-retirement years. If some of those funds are still getting funneled to you, it may be harder for your parents to have a comfortable retirement.

According to that Pew Research study about the transition to adulthood, 36% of parents who helped their children financially said that doing so hurt their personal financial situation at least somewhat. About half of parents with lower incomes who provided financial help to their young adult children in the past year (49%) say this hurt their own finances at least some. About 37% of middle-income and 22% of upper-income parents say the same.

How can I put myself on the path to financial independence?

You don’t have to do it all at once. But if you’re ready to declare your financial independence or at least begin moving toward it, here are some things to consider as you contemplate unwinding your financial entanglements:

Should I still be on my parent’s health insurance plan?

The Patient Protection and Affordable Care Act allows young adults to stay on a parent’s health plan until they turn 26. Your parents might not mind keeping you on their health plan until then, especially if they already pay for family coverage to insure your younger siblings.

If you’re ready to seek your own healthcare coverage, I wrote a post--Happy 26th Birthday! Hope you have a great day and you’ve lined up health insurance–that covers what you need to know.

Should I stay on my family’s cell phone plan?

Staying on your parents’ cell phone plan might not seem like a big deal because the monthly charges are relatively small. However, as financial guru Suze Orman points out, those payments shouldn’t be terribly hard to handle, and setting them up as auto payments can help you build a stronger credit score.

So maybe it is time to strike out on your own. Perhaps you can take advantage of a free phone or other incentive that companies offer to entice new customers.

If your parents’ family plan offers a discounted rate better than what you could get on your own, you could ask to stay on your parents’ plan but Venmo your parents monthly for your portion of the bill.

Do I really have to pay for my own streaming services?

Consider whether asking your parents to pay for your entertainment is fair at this stage of the game.

Netflix has declared that a Netflix account is for people living together in one household. If you’re living on your own, Netflix will allow your parents to add an extra member to their account for an additional fee ($6.99 per month with ads or $8.99 per month without ads). If you picked up the tab, it would be a step toward independence, yet still less than what you’d pay on your own.

If you decide to get your own cell phone plan, remember that some providers throw in a streaming service for free.

Should I contribute to expenses if I’m living at home?

This seems sensible. If you were living with someone other than your parents, wouldn’t you expect to contribute to covering the cost of your living arrangements?

According to Pew Research, most young adults who live with their parents contribute financially–65% say they pay for household expenses such as groceries or utility bills, and 46% say they contribute money toward the rent or mortgage.

Of course, expectations may vary by family. Some parents are of the mind that the family home is a rent-free dwelling for their offspring to enjoy for as long as they care to. If that’s the case, be thankful for your good fortune, do something nice for your parents periodically, and use the money you save to pay down debt or tuck it away in an account you can put toward a downpayment on your own home someday.

Should my parents help pay my rent?

It’s not uncommon for parents to cover rent while their kids are students. But if you’re a wage earner, surely you can’t expect your parents to put a roof over your head indefinitely. Perhaps it’s time to take another look at your inflows and outflows so you can make a plan to end this subsidy.

What about parents helping out during times of emergency?

We are all subject to unanticipated financial emergencies–job losses, natural disasters, the random collapse of our living arrangements, etc.--and during these times, your parents may graciously offer to serve as your safety net. (Presumably you would do the same if the situation were reversed.) If so, be grateful, reflect this gratitude in your words and deeds, and resolve to work as hard as you can to make this assistance as temporary as possible.

We should all be grateful that the Bank of Mom and Dad offered us trustworthy support for as long as it did–not everyone enjoys this blessing. But sooner or later, everyone needs to be able to bank on themselves. Declaring your financial independence isn’t always comfortable initially, but in the long run, you and your parents will be better off when you do.